You started out by filing for your own Social Security benefits that you earned from your own work and payment into the Social Security system. But now you’re wondering whether you can, instead, switch to a benefit as the spouse (or ex-spouse) of someone who made a lot more money than you did.

In short, the answer is, yes. Sometimes.

The rules around spousal benefits can be complicated. Generally speaking, you can only apply for spousal benefits if your spouse has applied for their retirement benefits. If your spouse is eligible for retirement benefits, but has not yet filed for them, you can’t apply. In such a case you would stick to your own benefits until your spouse files.

If, however, you are an ex-spouse, the rules are different. If you were married at least 10 years, and you and your former spouse are at least 62, and your former spouse is eligible for Social Security benefits, you may file for spousal benefits on their record even if they haven’t filed. Your filing as an ex-spouse will not impact the amount that either your former spouse or their current spouse receive.

How much can I get?

The maximum you can receive as a spouse or ex-spouse is 50 percent of your former spouse’s benefit at Full Retirement Age. So, if their benefit at Full Retirement Age would be $2,000 a month, you may be eligible to receive up to $1,000 a month if you wait until Full Retirement Age to file for spousal benefits. If your own benefit would have been smaller—say $700 a month—you will not be paid both; you’ll be paid the larger amount between your own benefit and your spousal benefit.

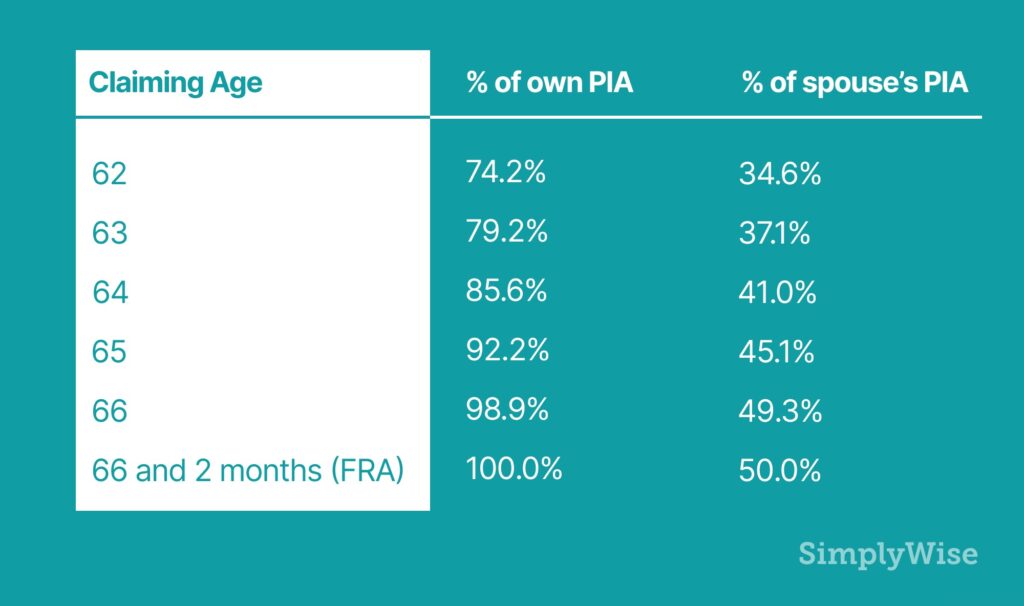

How much you receive, though, depends on when you file. If you file at age 62, you will receive a smaller percentage of your spouse’s benefit — roughly 30 percent versus 50 percent. Once you file for your benefits as a spouse, the amount you receive freezes at that amount for the rest of your life, which makes it worthwhile to see how long you can hold off. If you don’t file until Full Retirement Age, the percentage increases monthly from 30 percent at age 62 to 50 percent at full retirement. For someone born in 1955, the proportion by age until Full Retirement Age is as follows:

If your spouse does not file for their own benefit until age 70, they will receive a delayed retirement credit. You, however, are only eligible for 50 percent of their maximum benefit at full retirement, though you still must wait until they file to receive your spousal benefit.

Special rules for spousal benefits

Of course, you are eligible to file for your own retirement benefit at age 62—though your payment will be smaller than if you wait until Full Retirement Age. If you apply for your own retirement and your spouse has not applied for their benefit, you can receive your benefit and then switch to the spousal benefit when they file or when they reach Full Retirement Age.

Another option available to those born before January 2, 1954, is that they can file for only their spousal benefit at Full Retirement Age and delay filing for their own benefit until age 70. That would maximize their own benefit. But this option is not available to anyone born after January 2, 1954. If you were born after that and you apply for your own benefit, you automatically are recognized as having filed for all retirement or spousal benefits.

If you have a child under age 16 or disabled, you may be eligible for spousal benefits from Social Security Disability Insurance through your spouse.

You can apply for retirement benefits, spousal benefits, divorced spouse or Medicare benefits online at Retirement/Medicare Benefit Application. If your spouse is already receiving benefits when you apply, or if you and your spouse apply at the same time, the Social Security Administration will automatically check your eligibility for benefits as a spouse.

Switching to survivor benefits

If you are receiving spousal benefits and your spouse dies, you become eligible for survivor benefits. Survivor benefits entitle you to 100 percent of your spouse’s benefit amount at full retirement rather than 50 percent.

If your spouse passes, you must apply either by phone at 1-800-772-1213 or if you are deaf or hard of hearing, at TTY 1-800-325-0778. Or you can visit your local Social Security office.

Takeaways

In 2019, an estimated 64 million Americans collected Social Security benefits, and 61% of Americans aged 60 to 70 view Social Security as an “extremely important” source of income. Nevertheless, a great deal of confusion exists around the rules and this often causes people to miss out on much needed money. Knowing how age impacts Social Security is important, but it is but a first step on a journey of education.

Increasingly, online Social Security blogs and free calculators are emerging to help people avoid costly mistakes (we believe the SimplyWise Calculator is the best). Hopefully, with better education around the topic, Americans can maximize what they’ve earned.